Download MarketWatch

This article is from our October 2023 edition of MarketWatch.

19th December, 2023

Discover the incredible power of starting your investment journey early. This article explains the concept of compounding, how it works, and how it can significantly boost your savings and investments over time.

Are you familiar with the saying 'time is money'? Well, when it comes to investing, time can be more valuable than money itself. The concept of time is linked to the concept of compounding; a force that has the potential to turn modest investments into substantial wealth over the long term. Understanding and employing the power of compounding can be a game-changer in your financial journey, and the key lies in starting your investment journey early.

Compounding is the process of generating earnings not only on the initial investment but also on the accumulation of earnings over time. It is the process of putting your money to work, making money from your money earnings, creating a ripple effect that can multiply your wealth over time.

Let's take a look at an example of this. Consider an initial investment of €1,000 with an annual return of 8%. In the first year, the investment would generate a return of €80, increasing the value of the investment to €1,080. In the second year, the 8% would be applied not only to the initial €1,000 but also the €80 earned in the first year, bringing the new total to €1,166. Over time, this cycle repeats, and the earnings begin to accumulate at an accelerating pace.

One person who understands the importance of investing early is Warren Buffet, one of the world's most successful investors. He has often credited compounding as a tool to build wealth. According to Morgan Housel, Buffet started investing at age 10 and earned his first million by age 30.

Housel wondered what would have happened if, instead, Buffet was a typical person who spent his money in his teens and early twenties, had a net worth of $25,000 at 30, and retired and stopped investing at 60. He estimated his net worth in this instance would be about $12m today, a staggering 99.99% less than Buffet's current net worth of $120bn.

Time allows your investments to weather the storms of the market volatility and take advantage of the power of exponential growth. Even if you you start with a relatively small investment, the compounding effect can work wonders over several decades.

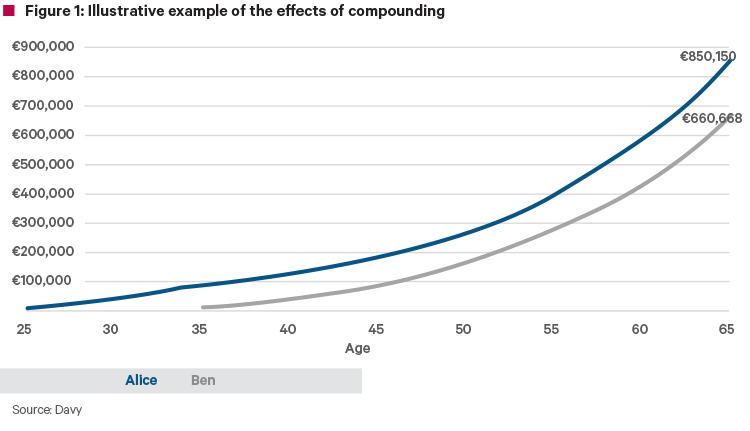

Let's illustrate this with an example. Take two friends, Alice and Ben, both eager to start their investment journeys with a goal of financial security in retirement. Alice begins investing €5,000 every year at 25 until she's 35 - a total of €50,000. Ben waits until he's 35 and invests €5,000 every year until he's 65, a total of €150,000. Both earn an annual return of 8%.

In graph 1, we can see that at 65, Alice's wealth has accumulated to €850,150 while Ben's wealth has reached €660,668. Despite contributing less, Alice's investment was able to surpass Ben's due to the power of compounding and the additional time Alice's investments had time to grow.

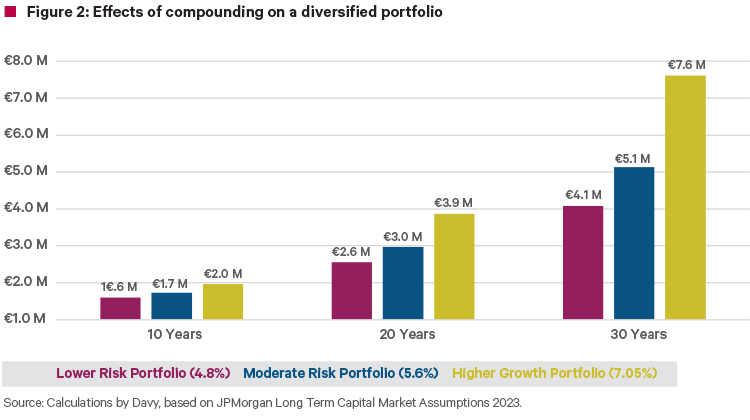

The power of compounding can be further amplified by leveraging the potential of the stock market and other investment avenues. By consistently investing in a diversified portfolio, individuals can benefit from compounding and the market's upward trend over the long run.

However, just as compounding can magnify gains it can also magnify losses. Poor investment choices or taking excessive risk can result in a depletion of wealth. Factors like inflation, taxes, and market volatility can impact the returns of an investment. It is important to strike a balance between seeking growth through compounding and preserving capital through risk management.

Graph 2 illustrates the power of compounding over time through the use of a low, medium, or higher risk diversified portfolio.

While compounding is a powerful investment tool, it is not a get-rich-quick plan. Patience is key to success with compounding. As seen with Buffet, the most significant gains tend to occur in the latter years of the investment horizon which is why starting early is important. Consistency in contributing to your investments and resisting the urge to withdraw prematurely can help achieve the full benefits of compounding.

By consistently contributing to your pension, you can take advantage of tax-free growth and the power of compounding. Over time, even regular small contributions can lead to a substantial nest egg, providing security in your retirement.

For parents aspiring to fund their children's education, starting an education fund early and allowing it to grow can significantly ease the burden of exceptional expenses when they arise.

The best time to start investing was yesterday, but the second-best time is today. Whether you're a recent college graduate or approaching retirement, understanding and applying the principles of compounding can significantly impact your financial well-being.

Remember, time is crucial to the compounding equation and when combined with the principles of compounding, it has the ability to transform your financial future. By making a commitment to save and invest consistently, diversifying your portfolio, and giving your investments time to grow, you position yourself to unlock the full potential of compounding.

So, start today, stay patient, and let the power of compounding work its magic over time.

This article is from our October 2023 edition of MarketWatch.

Warning: The value of your investment may go down as well as up and you may lose some or all of the money you invest. Past performance is not a reliable guide to future performance. Investments denominated in a currency other than your base currency may be affected by changes in currency exchange rates. Returns on investments may increase or decrease as a result of currency fluctuations.

Warning: Davy Select is designed for investors who are comfortable making their own investment decisions, without financial advice; this is known as “execution-only”. Execution-Only is not for everyone. You should ensure that you fully understand any investment and the associated risks before making a decision to invest. Alternatively, Davy can arrange for you to open a different type of account, where we can advise you in relation to investment decisions, or where we can manage investments on your behalf. Forecasts are not a reliable guide to future performance.

Warning: This website does not constitute investment advice as it does not take into account the investment objectives, knowledge and experience or financial situation of any particular person or persons. Prospective investors are advised to make their own assessment of the information contained herein and obtain professional advice suitable to their own individual circumstances.

It all begins with a simple, no obligation conversation.

For investors who are comfortable making their own investment decisions.